Lede

Some say software is just noise and only the chip barons and rail owners will rule AI. Cute idea. Not quite reality.

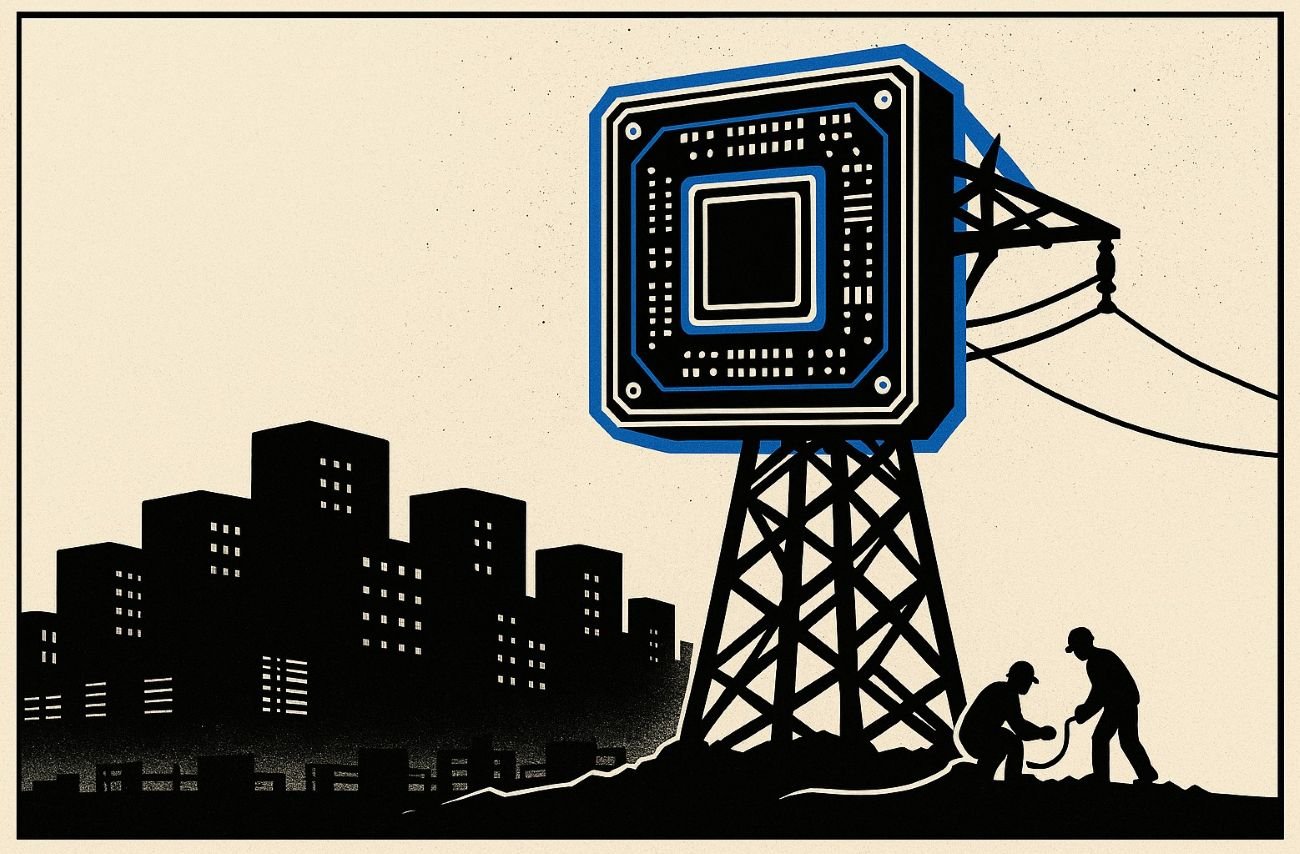

In the AI gold rush, the real winners are not the apps. It is the ones selling chips, energy, and infrastructure to everyone else. Code is abundant. Fabrication plants are not.

What does not make sense

- “Some companies are smarter than others” without naming one company, one chip, or one strategy. Wisdom by horoscope.

- Praising firms that “felt the future” instead of showing what they actually built, shipped, or patented.

- Talking about an “era of agentic and robotic AI” like it is a Netflix category, with zero explanation of what that means in practice.

- Treating hardware investors as pure visionaries while ignoring political risk, export bans, and power grids that are already wheezing.

- Imagining that companies with physical products are somehow behind, when those same firms are the ones buying the chips at scale.

- Claiming “physical rails” will stop AI “going tyrant” without saying what rails are: power, fabs, server farms, regulators, or just vibes with steel.

- Pretending software is easy and abundant, while the real shortage is land, electricity, cooling, and boring planning permission.

Sense check / The numbers

- Nvidia controls roughly 80 to 90 percent of the data centre GPU market for AI, and pulled in about 115 billion dollars of data centre revenue in 2024. This is not a side quest. It is the jackpot. [Nvidia data centre GPUs]

- Global semiconductor capital expenditure in 2024 was about 155 billion dollars, down 5 percent from 2023. The chip race is real, but even the giants are blinking at the bill. [Semiconductor CapEx]

- TSMC alone is expected to spend 32 to 36 billion dollars on capital expenditure in 2025, one company carrying a national sized infrastructure project on its back. [TSMC capex]

- Data centres already use around 415 terawatt hours of electricity a year, about 1.5 percent of global demand in 2024, and AI could push its share of data centre power use to 35 to 50 percent by 2030. [IEA, Carbon Brief]

- In the United States, data centre power demand is forecast to more than double by 2035, from roughly 35 gigawatts in 2024 to 78 gigawatts, with average hourly demand nearly tripling. The rail is not code. It is the grid. [BloombergNEF]

- Since October 2022, the United States and allies have layered export controls on advanced chips to China, tightened again in 2023 and 2024. Nvidia now assumes zero revenue from advanced AI accelerators in China after once holding about 95 percent of that market. Hardware hegemony lives and dies by politics, not just clever bets. [BIS, CSIS, AP, Tomshardware]

So yes, chips and rails matter. They are not a cheat code that replaces software, regulation, and plain boring human governance.

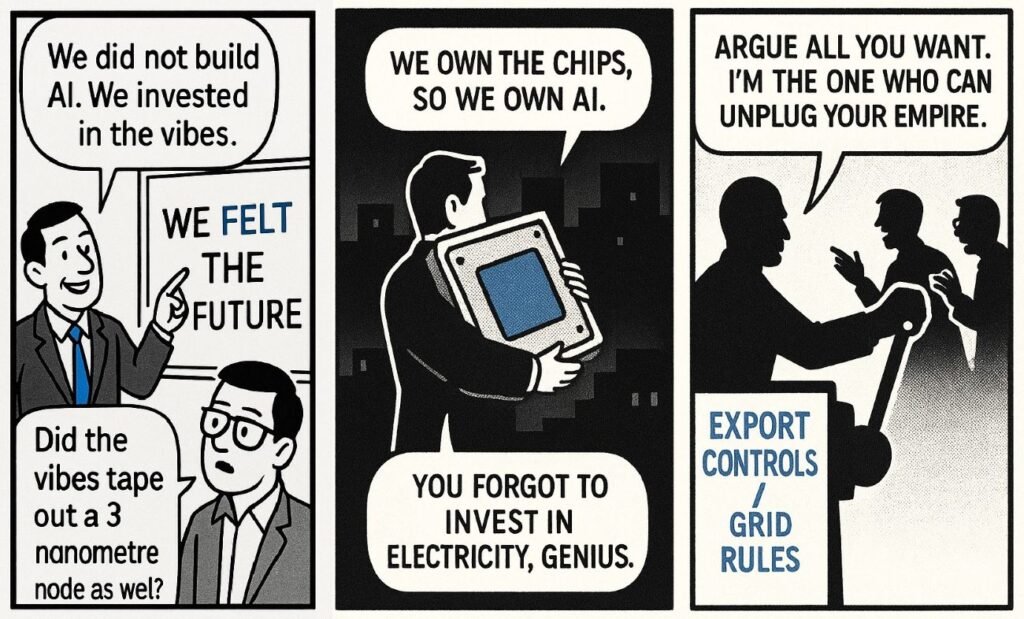

The sketch

Panel 1:

A smug executive points at a whiteboard that says “WE FELT THE FUTURE”.

Executive: “We did not build AI. We invested in the vibes.”

Engineer in the corner: “Did the vibes tape out a 3 nanometre node as well?”

Panel 2:

A different suit hugs a giant GPU like a teddy bear, standing next to a dark city.

Suit: “We own the chips, so we own AI.”

Behind him, all the streetlights flicker off.

Voice from the dark: “You forgot to invest in electricity, genius.”

Panel 3:

A regulator sits at a big lever marked “EXPORT CONTROLS / GRID RULES”.

On one side, chip CEOs and app founders shout at each other.

Regulator: “Argue all you want. I am the one who can unplug your empire.”

What to watch, not the show

- Concentration: a single chip vendor holding most of the accelerator market is not just “smart”. It is a systemic risk.

- Power: AI capacity now tracks grid upgrades, not press releases. No power, no training runs.

- Geography: fabs, data centres, and rare supply chain skills are clustered. One region sneezes, everyone else catches a compute shortage.

- Politics: export controls, antitrust, and safety rules can move faster than new fabs. The rails have parliaments attached.

- Software lock-in: CUDA, cloud platforms, and proprietary models still dictate who can use the hardware effectively. Tools are soft power.

- Climate: rising data centre emissions will drag AI into the energy and climate fight, whether the chip investors like it or not.

The Hermit take

The future of AI is not a single winner that “felt the future”. It is a messy triangle between chips, energy, and rules.

If you only bet on one corner, do not call it wisdom. Call it a hedge and keep your speeches short.

Keep or toss

Verdict: Toss.

Keep the core idea that rails and chips are strategic.

Toss the lazy narrative that software, politics, and people are side characters. The stack is tangled. Any story that pretends otherwise is selling comfort, not clarity.

Sources

Nvidia data centre GPUs and AI accelerator share – https://iot-analytics.com/leading-generative-ai-companies/

Nvidia AI accelerator market share estimates – https://patentpc.com/blog/the-ai-chip-market-explosion-key-stats-on-nvidia-amd-and-intels-ai-dominance

Global semiconductor capital expenditure 2023-2024 – https://www.semiconductorintelligence.com/semiconductor-capex-down-in-2024-up-in-2025/

TSMC capital expenditure outlook 2025 – https://www.trendforce.com/news/2024/10/14/news-tsmcs-capital-expenditure-expected-to-remain-unchanged-this-year-ahead-of-earnings-call/

IEA – Energy and AI, data centre electricity use – https://www.iea.org/reports/energy-and-ai/energy-demand-from-ai

Carbon Brief – AI share of data centre power use – https://www.carbonbrief.org/ai-five-charts-that-put-data-centre-energy-use-and-emissions-into-context/

BloombergNEF – US data centre power demand forecast – https://about.bnef.com/insights/commodities/power-for-ai-easier-said-than-built/

US export controls on advanced chips to China – BIS summary – https://www.bis.doc.gov/index.php/documents/about-bis/newsroom/press-releases/3161-2022-10-07-bis-press-release-advanced-computing-and-semiconductors-to-china/file

CSIS – Limits of chip export controls analysis – https://www.csis.org/analysis/limits-chip-export-controls-meeting-china-challenge

AP News – US expands list of Chinese tech firms under export controls – https://apnews.com/article/8f8ab1ab49b5bb57e5a290a3937fa939

Tomshardware – Nvidia China AI GPU market share falls to zero – https://www.tomshardware.com/tech-industry/jensen-huang-says-nvidia-china-market-share-has-fallen-to-zero