Lede

Call it what it is: a giant kit-out of servers, power, and cash.

What does not make sense

- Calling it a bubble while every sector is wiring AI into workflows.

- Pretending AGI is required before value shows up.

- Waving quantum as next month while chips and power do the work today.

- Saying the money is not debt when big cheques are debt-backed.

- Ignoring the energy bill like it pays itself.

Sense check / The numbers

- Private AI money is not a vibe. In 2024, US private AI investment hit 109.1 billion dollars. Generative AI alone drew 33.9 billion. Reported AI use in firms jumped to roughly three in four. [Stanford HAI]

- The power problem is real. The IEA projects global data centre electricity use could more than double by 2030 to about 945 TWh, with AI the biggest driver. [IEA]

- Buildout is peaking now. Data centre capex is set to rise more than 30 percent in 2025 as hyperscalers race to add AI capacity. [Dell’Oro]

- Debt is in the mix. Analysts flag that more AI build is financed by borrowing, not just cash flow. Private credit and bond deals are piling in. [Citi via Investopedia; Bloomberg]

- Supply chain signal. Nvidia posted 130.5 billion dollars revenue for fiscal 2025, with record data centre sales. That is not a paper fad. It is boxes on floors. [Nvidia]

- Quantum is promising but not here to save your spreadsheet. Research advances keep coming, but fault tolerance remains years away and scenario planning reflects uncertainty. [MIT; Deloitte; MIT QIR]

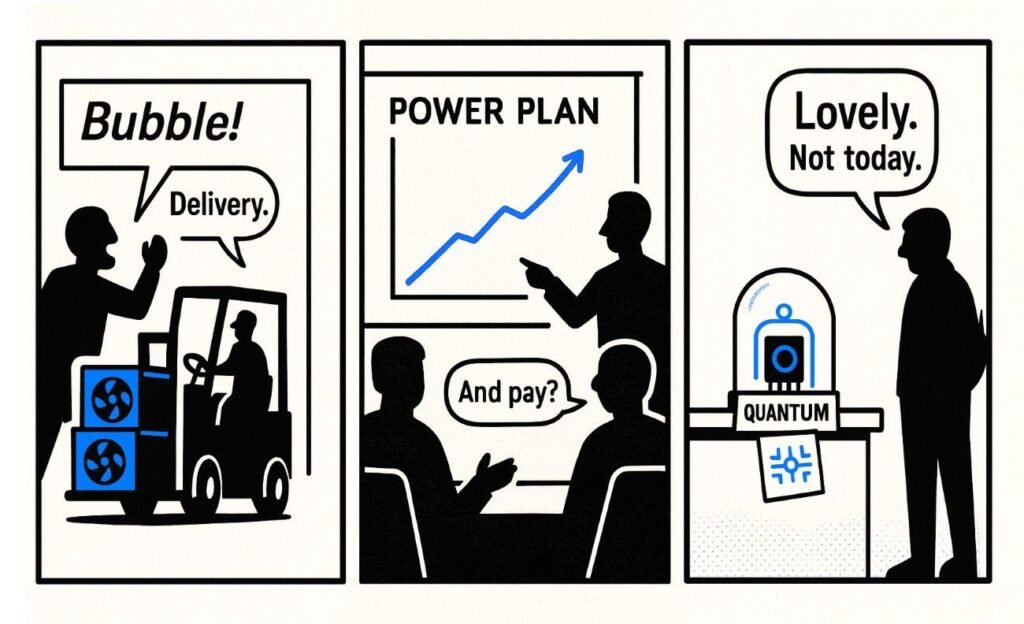

The sketch

- Scene one: A trader yells, Bubble. A forklift rolls past with racks of GPUs. The forklift driver shrugs.

- Scene two: Boardroom. Slide reads, Power plan. The CFO points at a rising debt graph. Everyone nods like it is fine.

- Scene three: Lab bench. A quantum chip in a glass box. Label: lovely, not today. The engineer smiles, tomorrow maybe.

What to watch, not the show

- Grid strain and prices where new data centres land.

- Debt costs vs cash flows as rates shift.

- Regulator mood on energy, water, and siting.

- Vendor concentration risk in chips and networking.

- Workflow rewiring beyond pilots, not demo theatre.

- Quantum milestones that move from papers to products.

The Hermit take

Not a bubble. A build. With a meter running and a bank behind it.

If it adds value, it stays. If it adds only press releases, it goes.

Keep or toss

Verdict: Keep.

Keep the buildout that pays for itself. Toss the blanket bubble talk.

Sources

Stanford HAI – 2025 AI Index headline figures:

https://hai.stanford.edu/ai-index/2025-ai-index-report

Stanford HAI – Economy chapter, gen AI funding:

https://hai.stanford.edu/ai-index/2025-ai-index-report/economy

McKinsey – State of AI 2025 survey summary:

https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

IEA – AI and energy, 2030 projections:

https://www.iea.org/news/ai-is-set-to-drive-surging-electricity-demand-from-data-centres-while-offering-the-potential-to-transform-how-the-energy-sector-works

Dell’Oro Group – Data centre capex set to rise in 2025:

https://www.prnewswire.com/news-releases/hyperscaler-ai-deployments-lift-data-center-capex-to-record-highs-in-2q-2025-according-to-delloro-group-302557060.html

Investopedia – Citi note on debt financing AI buildout:

https://www.investopedia.com/big-tech-s-ai-spending-and-borrowing-will-be-even-higher-next-year-says-citi-11821812

Bloomberg Newsletter – Big debt deals in the AI boom:

https://www.bloomberg.com/news/newsletters/2025-10-06/big-debt-deals-throw-fuel-on-the-ai-boom

Nvidia – Fiscal 2025 results and data centre revenue:

https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-fourth-quarter-and-fiscal-2025

Nvidia – Q2 fiscal 2026 update:

https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-second-quarter-fiscal-2026

MIT News – Step toward fault-tolerant quantum:

https://news.mit.edu/2025/mit-engineers-advance-toward-fault-tolerant-quantum-computer-0430

Deloitte – Quantum futures scenario planning:

https://www.deloitte.com/us/en/insights/topics/emerging-technologies/quantum-computing-futures.html

MIT QIR 2025 – Quantum funding and trends:

https://qir.mit.edu/wp-content/uploads/2025/06/MIT-QIR-2025.pdf